Around this time last year I defined for you the?Yiddish word ?mishegoss,? which many of you were familiar with in spite of never having heard the term before. Yiddish is just that way ? it taps into certain archetypes in our consciousness and, as a result, a phrase that we might never have heard before seems familiar, even comfortable. Think of how many times you dropped something and called yourself a?klutz, or declared as a maven a person whose expertise impressed you. And then there are all the times?you have thought to yourself, ?what a?schmuck.? Or how you marveled at a that politician whose?chutzpah took your breath away. Matter of fact, those last two may have occurred to you simultaneously.

Well mishegoss is defined as craziness or senseless activity and it is a word that comes to mind for many managers as they start the winding-down process on anther year in business. So much to do and only the next 6 weeks or so to do it. Last year, I posted a list of 8 general things that every business needs to start on as New Year approaches, but this year I want to concentrate specifically on the financial and tax planning realm.

Since we started this company back in 2006, we have steadily put in place systems and procedures for periodic reviews of our accounting and finance with the hope that?errors in bookkeeping would be identified and?tax preparation would be streamlined. So far, we have succeeded in the former and these reviews do indeed help us when analyzing costs and identifying savings. Unfortunately, we have yet to tame the beast that is our tax return, but this year we have great hope that we will provide the information to the accountants earlier than ever, correct the problems that arise, and get the myriad paperwork completed earlier than ever before. Hope, after all, does spring?

Here then are some thoughts on how you can better prepare your books and your business records to keep your bookkeeping on track, your accounting bills reasonable, and your investors confident that their own tax returns can be completed on time this year!

1.?Plan ahead.? First things first ? pick up the phone and call your accountant (as soon a you finish reading this post that is). The whole dea of this exercise is to make sure that you are not scrambling on January 1st to pull together the documents and data that will be needed to prepare your taxes for 2012. In order for your accountant to do their job, they need accurate and detailed information about your business, your sales, your expenses, your vendors, your bank accounts, your loans, your payroll, your employee benefits?. Get the picture?

A good accountant will always identify problems with your books, whether it is a simple input error or a mis-categoriaztion of an expense item. When we go through this process we always anticipate that there will be several rounds of back and forth before everything is ready for the accounting work needed to start tax preparation. To help us in this process we have created a simple checklist of all the items that our accountants need to review and make corrections to ? our list is roughly a dozen various items and I have listed some of the common ones below.

So schedule a meeting with the accountant today.?Make a list of everything she?ll need. Go over it with the bookkeeper. Then do the needful and start assembling that package as soon as possible.

2. Payroll.?One of the first items on the accountant?s list will be a?payroll journal showing YTD totals. Have the bookkeeper make sure the following items on the ledger tie to the payroll journal: total salaries and wages, total payroll?taxes, and any total guaranteed payments or other payroll items.

3.?Employee benefits.?401k?s or other retirement benefits also need to be provided. The total amount withheld from your employees must be carefully reconciled to payments made.?Health benefits, too should be carefully accounted for to ensure that you receive the maximum benefit for providing these to your team.

4.?Bank and credit card statements.?Be sure to download or copy all of your bank and credit card statements?as of period end and provide these to the accountant with the reconciliation for each account. We are currently preparing these reconciliations as of the end of October, which will give us two more months to make any needed changes or corrections before we close the books on 2012.

5.?Outstanding loans or other employee obligations.?It is not out of the question that you may have made a loan to one of your employees, whether via a salary advance or through some other arrangement you negotiated. It is critical that your accountant have full detailed information on any loan or other obligation so that it can be properly reflected in year-end bookkeeping.

6. Quickbooks file.?Your accountant will need a copy of your current file to assess and to check all of your reconciliations and account designations.?This can get tricky as your bookkeeper will need to continue paying bills and such while the accountant is evaluating and making changes to the file, but your accounting software can accommodate this. Here is what Quickbooks states in their support resources: ?An Accountant?s Copy is a version of your company file your accountant can use to make changes while you continue to work. When your accountant is done, you can then import his or her changes into your company file. Create an Accountant?s Copy file and deliver it to your accountant (email, CD, or other method). Before you begin, coordinate with your accountant on a dividing date. This date defines the fiscal period your accountant will work on.?

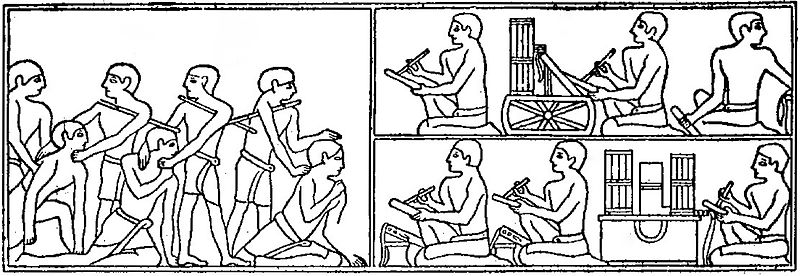

Illustration: ?Egyptian peasants seized for non-payment of taxes??from ?The Outline of History (1920),? by H.G. Wells

Related posts:

- Small Business and Startups: End-of-Year Mishegoss, 2011 Version

- Small business and startup tip: managing bookkeepers, accountants, and the end-of-year mishegoss

- Ten small business tax planning tips for 2010!

- 10 random online resources for Entrepreneurs (2010 version)

- Small business and startups: 5 great self-service HR resources

Source: http://blog.crowdspring.com/2012/11/small-business-and-startups-end-of-year-mishegoss-2012-version/

linkedin linkedin Samsung Galaxy S3 usps ups bachelor pad bachelor pad

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.